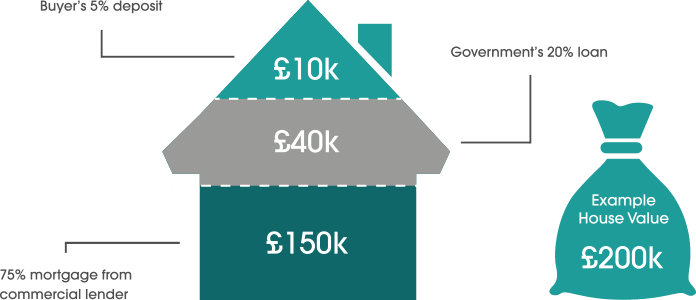

The government Help to buy scheme is one of the most well-known property incentive schemes that is currently running. Having proven to be a success in the UK housing market, it has allowed over 169,000 people to move into new homes*. Offering a more affordable route to market is something that we fully support. Giving homeowners the opportunity to move up the property ladder sooner, this scheme allows buyers to put a minimum of 5% deposit for any eligible property. From this, you will receive a 20% equity loan from the government to top up your deposit. This will mean you only require 75% of the property value to secure a mortgage.

If you are an existing homeowner or looking to buy your first property, you can utilise this scheme when buying a new build property supported by the Help to Buy scheme, irrespective of if it has been recently built or currently off-plan.

Only needing a 75% mortgage can open you up to a range of competitive mortgage rates. This can save you thousands across the term of your mortgage. In addition to this, there is no interest charged on the equity loan for the first five years. This allows for breathing room to settle into your new home and makes it more achievable to save or allow you to start paying down the equity loan early.

If you wish to learn more about the Help to Buy Equity Loan scheme, we can introduce you to our trusted Specialist Mortgage Advisors. They who will be able to search the whole of the market to find you the best mortgage based on your unique criteria.

* Statistics published by Ministry of Housing Communities & local government as of data between 1 April 2013 to 31 March 2018.

Help to Buy is available for first-time buyers as well as existing homeowners. There are a few conditions to check to see if you are eligible for the scheme:

While we have made every attempt to ensure that the information mentioned has been obtained from reliable sources, HM Government Help to Buy advisors, IFAs. We are not responsible for any errors or omissions, or for the results obtained from the use of this information. We would advise speaking to an independent financial advisor when looking to purchase a mortgage with the Help To Buy scheme. We are able to put you in contact with our preferred whole of market IFAs, who offer tailored impartial advice, for there details please click here

Follow us on